As coverage is utilized, the asset’s value decreases, remodeling into an expense on the income statement. The “prepaid” aspect signifies that the cost is incurred, but the insurance benefit shall be consumed over a future period. The payment offers a future claim to a service, providing safety against unforeseen events. This unexpired portion of the premium represents a resource https://www.kelleysbookkeeping.com/ the corporate controls and from which it expects to derive future value.

Pay As You Go Insurance Instance Journal Entry

- Pay As You Go insurance coverage is taken into account an asset as a result of it meets important standards.

- Simultaneously, they scale back the pay as you go insurance coverage asset account by the identical quantity.

- For occasion, a enterprise would possibly pay a lump sum on January 1st for a policy overlaying the entire upcoming yr.

Each month, the company acknowledges 1,000asaninsuranceexpense(1,000asaninsuranceexpense(12,000 divided by 12 months). An adjusting entry is made by debiting insurance coverage expense and crediting prepaid insurance. By the tip of the 12 months, the entire prepaid quantity may have been expensed, and the pay as you go insurance account steadiness might be zero.

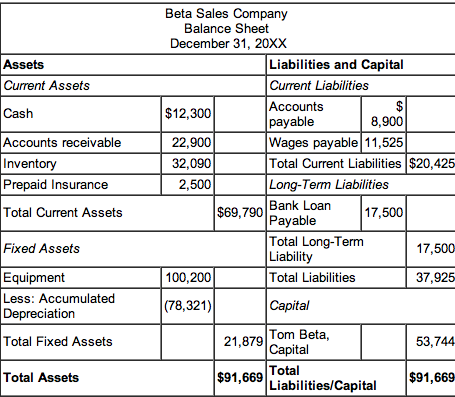

This can mislead traders, lenders, and other stakeholders who depend on accurate financial statements. Firms that constantly misallocate prepaid insurance coverage might face audit scrutiny and potential restatements of financial reports. Accountants should track the consumption of insurance coverage coverage by understanding coverage phrases corresponding to protection length and renewal dates. This systematic allocation of the pay as you go insurance asset to the expense account usually includes utilizing accounting software program to automate monitoring and changes, reducing errors and enhancing accuracy. Pay As You Go hire cozies up within the present belongings section of the stability sheet, right alongside cash and other short-term property.

What Is The 12-month Rule For Pay As You Go Expenses?

With a lease, the gear isn’t yours to maintain (so no doodling your brand on it). In the meantime, the pay as you go lease payments sit pretty within the present assets part of the stability sheet. As time passes and corporations get pleasure from the benefits of the gear, they document adjusting journal entries to shift amounts from prepaid lease gear to lease expense. It’s like paying for a gym membership—use it or lose it (and perhaps really feel a little responsible alongside the way). Debit the insurance expense account and credit score the pay as you go insurance account.

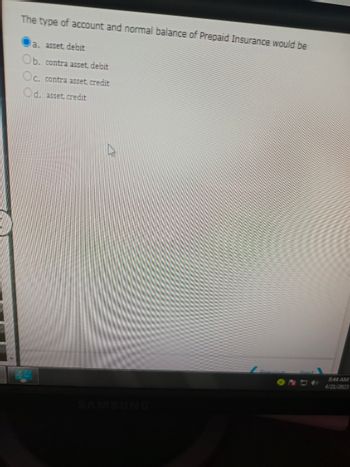

It arises when a business pays for insurance protection prematurely, usually for a interval of several months or a full 12 months. This upfront cost represents a future financial benefit as a result of the company has the right to obtain insurance coverage coverage over the paid period. Adjustments have to be recorded constantly to adjust to accounting standards. At the tip of each period, an adjusting journal entry transfers the appropriate portion of prepaid insurance to the expense account. This entry debits the insurance expense account and credit the pay as you go insurance coverage asset, guaranteeing only the remaining unused portion stays categorised as an asset.

Oil Rises On Demand Hopes, Financial Information Enhance Stocks Sentiment

Recording prepaid insurance transactions may look hard initially, however you can make it simpler with a clear plan. The primary idea is to treat it as an asset at first and then slowly acknowledge its cost as time passes. Profitability metrics expertise momentary inflation since amortization timing delays expense recognition. Your ROA and ROE appear stronger initially however normalize as insurance coverage is prepaid insurance an asset on a balance sheet coverage is consumed. Assets and liabilities are categorized into short- and long-term subcategories, and within these classes, you would possibly even see a number of assets. Pay As You Go insurance is a present asset as a outcome of it’s an asset that you could rapidly convert into cash (within a year).

Is Pay As You Go Insurance An Asset, Legal Responsibility, Or Equity?

If accounting had a recreation present, pay as you go insurance can be the “Pinata of Timing.” It’s the sly expense that pops up at sudden moments, leaving you scrambling for solutions. So, how does this magical time-traveling insurance coverage play out on your balance sheet? Well, it’s like a little acrobat balancing on a excessive wire, however as an alternative of a net, it’s your general financial well being at stake. Let’s speak about pay as you go insurance coverage, a unique however crucial part of your financial toolkit.

Companies should not solely monitor property and liabilities, but additionally capture increases and reduces in their values. One example of this want for increased precision is with prepaid insurance, which may be treated differently relying on the business type. For some companies, pay as you go insurance coverage is classified as a current asset beneath ‘Other Current Assets’ while others listing it as a liability beneath ‘Prepaid Expense’. Pay As You Go insurance is a time period usually encountered in the accounting and monetary world, especially for companies and individuals managing their financial statements. It refers to insurance coverage premiums which are paid upfront for protection that may apply over a future interval.